Mission

What I Can Offer You:

Eliminate

Utility Bills

$0 Down

Solar Program

Earn $$$

Per Referral

🚨🚨🚨

Inflation Reduction Act (IRA)

Homeowners who install designated solar energy systems will receive a tax credit of 30% of the cost from their federal income taxes.

New York State

25% tax credit is available for purchased home solar systems in New York. *Up to $5,000 state tax reduction.

New York City

Property tax abatement on the added home value from a solar system. *NYC ONLY

Inflation Reduction Act (IRA)

Homeowners who install designated solar energy systems will receive a tax credit of 30% of the cost from their federal income taxes.

State of Massachusetts

15% tax credit is available for purchased home solar systems in Massachusetts. *Up to $1,000 state tax reduction.

SMART - MA Solar Program

Your utility will pay you a fixed rate-per-kilowatt-hour (kWh) of solar energy your solar panels produce for 10 years.

Inflation Reduction Act (IRA)

Homeowners who install designated solar energy systems will receive a tax credit of 30% of the cost from their federal income taxes.

State of Florida

Under Florida’s Solar and CHP Sales Tax Exemption, Floridians are exempt from paying the 6% sales tax on solar panels.

Net Metering

In Florida, utility companies compensate solar homeowners at a full retail price each month, with any surplus credits reconciled at the avoided cost rate at the end of the year via net metering.

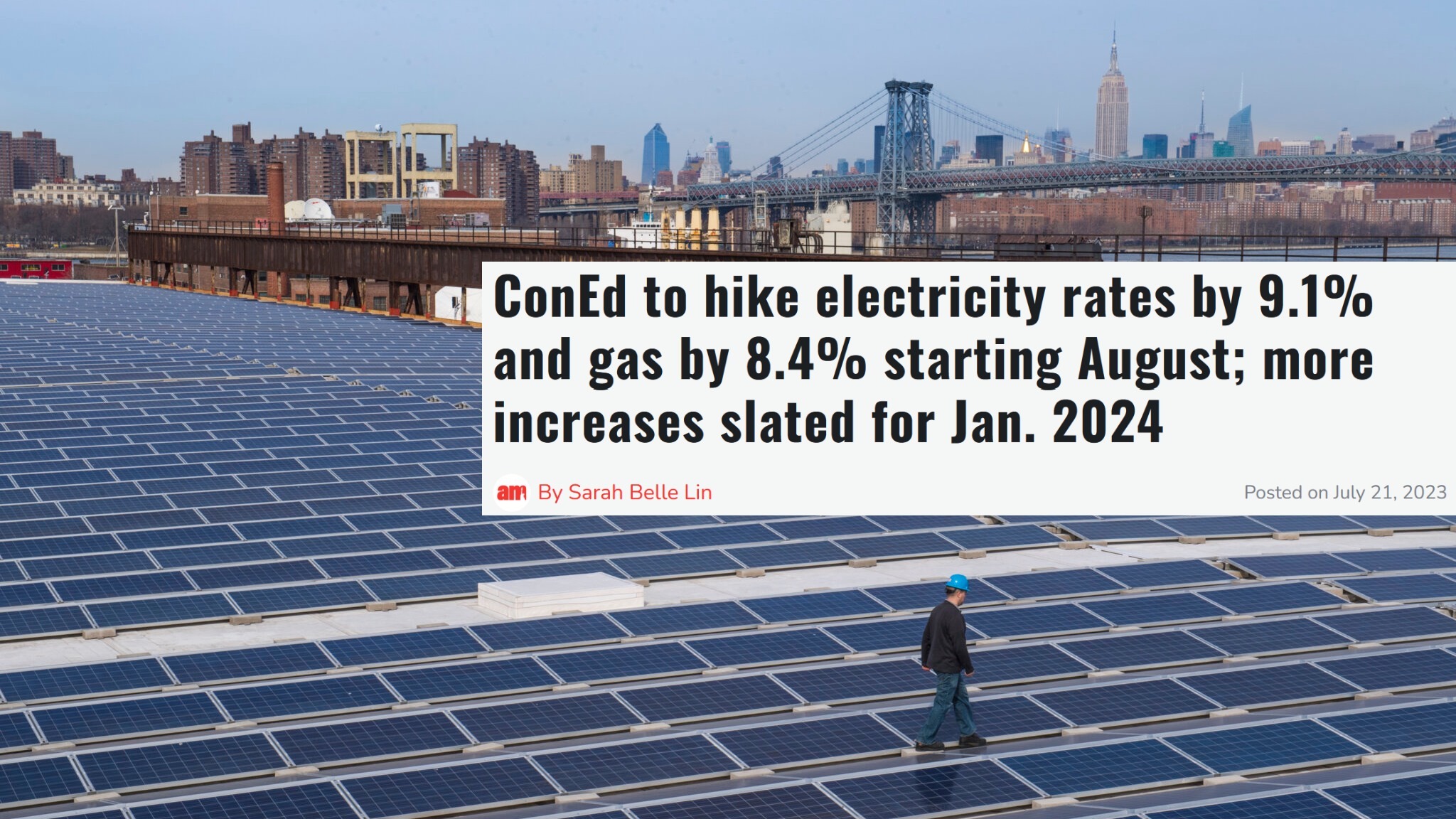

In The News

Groundbreaking for New York State’s Largest Solar Carport and Battery Storage System at JFK Airport

Common Solar Myths and Misconceptions

Myth 1

Solar only works when the sun is shining. I still need power when it’s raining.

On top of that, battery storage can be connected to your solar panels and provide energy at night. This is your clean-energy backup, as opposed to conventional backup generators—if the power goes out in your neighborhood, your power will stay on.

Myth 2

Solar panels aren’t efficient enough.

Truth is, the sun produces an enormous amount of energy—the sunlight that shines on the earth in just one and a half hours has more power than the world consumes in an entire year. With this huge energy supply, commercially available solar panels provide plenty of power to meet your home’s needs, at a cost at or below electricity provided by the grid in most parts of the country.

Myth 3

Solar is too expensive.

And solar panels require little ongoing maintenance—they are durable and reliable. If you live in a dusty environment, you may want to clean them once a year to maximize power output, but that’s about it. As demand for solar energy continues to grow, SETO is working to ensure the costs keep declining.

Myth 4

The government will give you free solar panels.

The federal investment tax credit (ITC) allows you to claim 30 percent of the cost of your solar installation as a credit toward what you owe in federal taxes. Depending on where you live, your state or local government may also provide additional solar incentives such as tax credits, rebates, or performance-based incentives (PBIs).

Myth 5

Solar panels will damage your roof.

For one, solar installation companies will inspect roofs before installing. An engineering and structural review of your roof will confirm whether or not it can withstand the added weight of a solar installation. Most solar installations will require holes in the roof to affix the racking, but sealants at these holes will prevent roof leaks. Solar installers will also provide a workmanship warranty (typically 5 to 25 years) to protect you on the off chance that damage occurs due to their installation work.

As long as you work with a qualified, licensed solar professional, you won't have to worry about roof damage. Stories of roof damage after solar installations are usually a result of a poor installation or a company installing solar on a roof that wasn't in good condition to begin with.

More false facts are:

- Solar panels can cause cancer

- Solar is a liberal thing

- Going solar costs so much money

- Solar drives down property value

- Solar requires a lot of maintenance

Goals | Nationwide

Dec 2021

Catalyzing Clean Energy Industries Through Federal Sustainability

Long-Term Goal: Pathways to Net-Zero Greenhouse Gas Emissions by 2050

Goals | Statewide

New York

Massachusetts

Florida

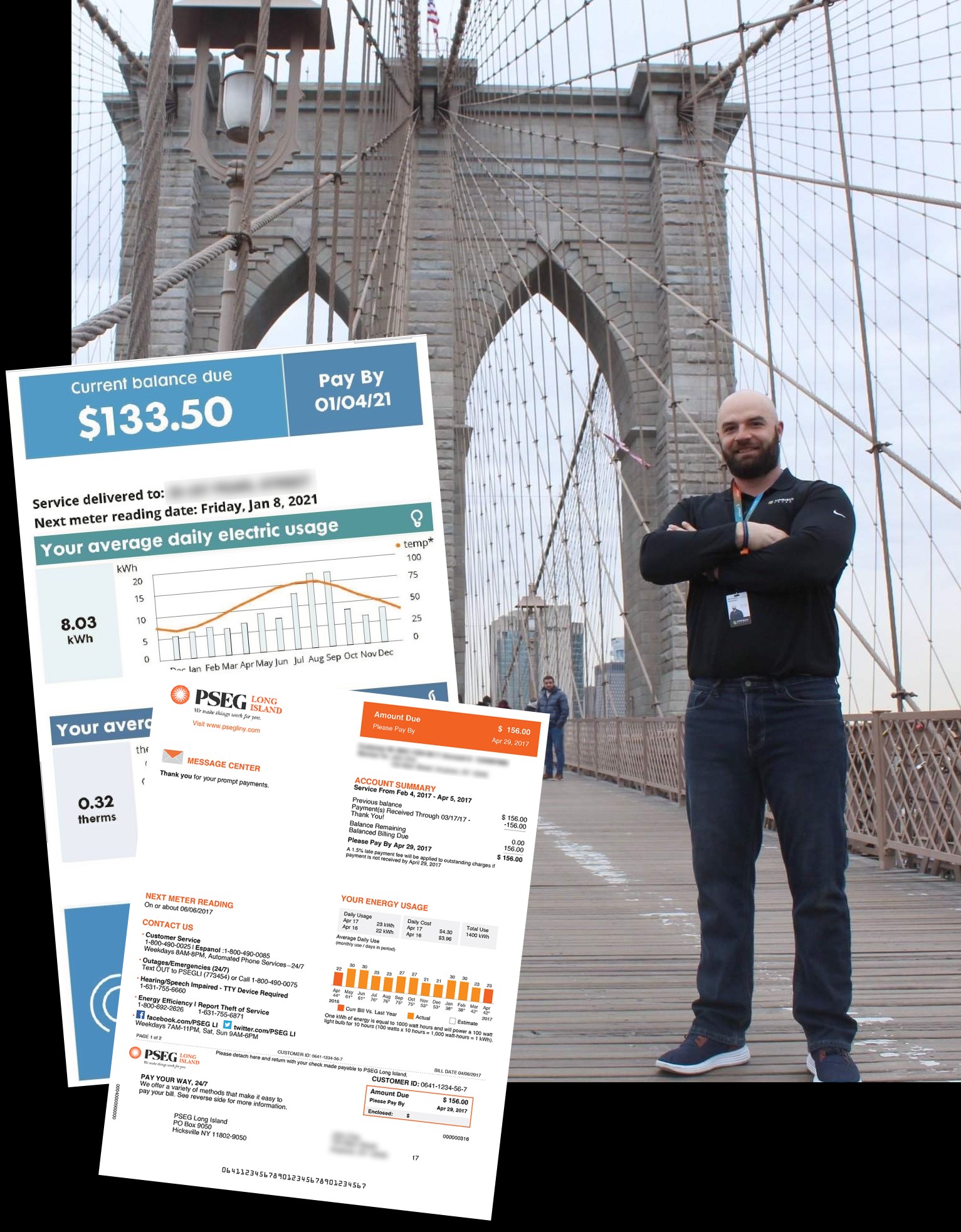

Free Savings Analysis

With the help of your electric bill, I will be happy to conduct a savings analysis for you − free of charge